What to Do if Your Company Does Not Match 401k

A growing number of companies and institutions have or are planning to finish matching contributions to their worker'due south 401(k) plans every bit a result of the COVID-nineteen pandemic, according to contempo reports.

And then what communication do certified financial planners accept for workers who are facing this state of affairs?

Increase Your Savings

The most common match is 50 cents on the dollar up to six% of the employee's pay. And that translates into five.1% percentage of a worker's pay, co-ordinate to the Plan Sponsor of America's 61st Annual Survey of Profit Sharing and 401(k) Plans. Put some other way: employers contribute, on average, $4,040 per year, according to Allegiance research.

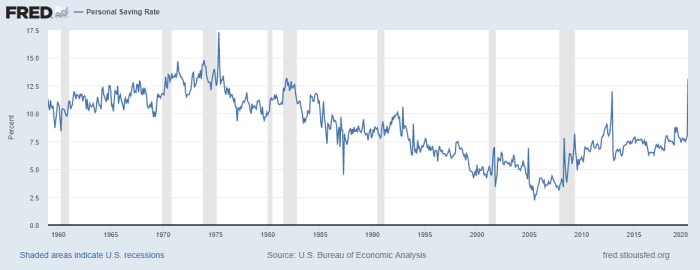

Many advisers suggest increasing, if you are able, how much you save in your 401(k) or other types of investment accounts to starting time the loss in matching contributions from your employer. "It's time to revise your plan," says Chris Chen, a certified financial planner with Insight Financial Strategists. "This may be an opportunity. According to the FRED, those people who still accept jobs have seen their savings charge per unit actually increment. Maybe they can increase their retirement contribution?"

Personal Saving Charge per unit

Philip Herzberg, a certified fiscal planner with The Lubitz Fiscal Group, is of the aforementioned opinion. "I would advise workers to maintain their retirement contributions or fifty-fifty increase them," he says. "Even though your firm may have suspended matching contributions, you tin keep contributing to your 401(thousand) on your own."

If y'all can afford to, elect to contribute more than in order to make up for the temporary loss of your employer's 401(g) match.

For her part, Danielle Harrison, a certified financial planner with Harrison Financial Planning, says in that location are several options to consider including standing to fund your employer-sponsored programme.

"Ane gene to wait at earlier doing this is the quality of the plan," she says. "Does the plan accept a diversified offering of low-cost funds and investment options? Are in that location low program fees? If the answer to both of these is yes, so, by all ways, continue to sock away funds in your employer-sponsored accounts. For high wage earners, this may exist the easiest style to fund your retirement needs without having to make other more complicated moves, such equally utilizing a backdoor Roth conversion."

Salve In A Roth 401(k) Or Roth IRA

Brandon Opre, a certified financial planner with TrustTree Financial, says employees who no longer have a 401(g) match should consider saving in other investment accounts instead. "Contributing upwardly to the 401(k) match limit has e'er been a 'no brainer' but absent-minded the match, it levels the playing field with the other vehicles such every bit a Roth IRA."

Investment accounts outside of your retirement plan can offering more flexibility of investment options available, he says. "Non all plans offering a Roth 401(k) choice anyways, so contributing to one straight - or using a back-door strategy - might be a good option for yous," says Opre. "Of course you'd need to know to execute this strategy, or work with a professional person who tin guide you."

For his part, David Mullins, a certified financial planner with David Mullins Wealth Management, the break of a 401(yard) friction match should be an opportunity to examine your employer-sponsored plan. "The opportunity may exist to contribute to a Roth or traditional IRA with additional investment options and/or lower costs," he says.

According to Hertzberg, contributions to a Roth IRA are made with funds on which you lot've already paid income revenue enhancement. "There is frequently more flexibility when it comes to Roth IRA investment choices and withdrawals than there are with traditional or Roth 401(thou) plans.

Read Is Now a Skilful Time for a Roth IRA Conversion?.

When looking at other options such as IRA or Roth IRAs, Harrison notes that there are many do-it-yourself options with very depression fees, such as Vanguard, Fidelity, or Schwab. "You can too await at working with a financial adviser, but please brand sure to do your homework. Ask how the adviser is paid and if they human action as a fiduciary - putting your interests to a higher place their own - in all aspects of the relationship."

Many advisors, she says, just manage investment assets without giving personal financial planning advice to their clients. "If that is the instance, you demand to weigh the fees and commissions they will receive versus the value you receive from them," she says.

Read 10 Questions to Enquire Your Financial Counselor.

Another valuable pick to consider, says Opre, is greenbacks value life insurance, or just saving into a taxable investment business relationship. "Both of these options provide different sets of benefits than a 401(k) would.

Out-of-the-box Options For Retirement Funds.

If you have a high deductible health plan, you could besides look at maxing out a health savings account (HSA), says Harrison. "You get a triple taxation benefit, no taxes on the money yous contribute, taxation-costless growth, and revenue enhancement-free distributions if you lot use the funds for medical purposes, either now or at retirement," she says. "After age 65, if y'all use the funds for a non-qualified purpose, you will have to pay ordinary income taxes on the funds, just that is no different than having the funds held in an IRA."

Don't Stop Saving

At a minimum, don't stop contributing to your 401(thousand) says Dan Galli, a certified financial planner with Daniel J. Galli & Associates. "You even so need to save for retirement and the taxation benefits (either pretax or Roth) are helpful," he says. "Plus, it'southward automatic which means it will happen."

Others share this point of view. "An employer suspending a friction match can't be an alibi to not contribute," says David Shotwell, a certified financial planner with Shotwell Rutter Baer. "Rather, the employee contributions are now more important as the retirement demand doesn't change. It may mean the 401(grand) is no longer the best option, depending on how much y'all are saving, available funds, etc."

And Mullins noted some other benefit of saving in a 401(k). "Money you contribute into a pretax 401(1000) is money you are not taxed on for the year," he says. "This means immediate tax savings at present with the added bonus of tax-deferred compounding interest within the business relationship. Taxes won't exist due until y'all withdraw funds, hopefully in retirement when your tax bracket is probable lower."

And don't forget about the return on investment. An employer match is certainly a nice perk, says Rob Greenman, a certified financial planner with Vista Capital Partners. "A 100% return on an investment would be tough for fifty-fifty Warren Buffett to beat," he says. "Notwithstanding, it's not the merely reason to sock away funds in a 401(m). Putting employee salary deferrals into pretax or Roth 401(k)s during times of uncertainty can provide fruitful returns. Retrieve about the employees who continued to sock away funds in their 401(k) business relationship dorsum at the depths of the financial crunch. Those entry points in the market were handsomely rewarded."

Others betoken to the benefits of dollar-cost averaging as a reason to keep saving.

"While a cut in benefits is disappointing, workers should not necessarily change their contribution," says Neal Nolan, a certified financial planner with Parsec Fiscal. "This could exist a huge fault, especially at current market levels. Dollar-cost averaging is actually of import and over fourth dimension the market volition rise to a new loftier."

From a retirement readiness perspective, he says workers volition be much ameliorate off continuing their contributions. "However, at that place are circumstances when information technology may exist prudent to reduce or end bacon deferrals," says Nolan. "That decision should be carefully weighed. If a worker stops contributions, I recommend restarting them as shortly as possible."

Another adviser likewise sees the advantage of buying depression. "You lot might have lost some value in your account recently, but the good news is that your connected contributions allow you lot to 'purchase at a bargain' because prices have gone downward," says David Haas, a certified financial planner with Cereus Financial Advisors. "You are likely to have made coin by the time you retire.

And still others say there'south a benefit in using other people's coin, as in Uncle Sam's, to keep saving in a 401(k). The match is probably the best benefit of the 401(grand), but it certainly is non the merely benefit, notes Mark Wilson, a certified financial planner with MILE Wealth Management. "401(g) contributions allow you lot to relieve taxes, invest the regime's money, and add together subject area to the investment process," he says. "In the end, those making 401(k) contributions will have more than coin (fifty-fifty without a match) than those skipping these plans."

The benefits of pretax savings cannot be understated either. If your income and expenses remain the same, and the but aspect of your compensation that has inverse is that your employer has suspended the 401(k) lucifer—there should be no reason to change your saving strategy, says Daniel Trumbower, a certified financial planner with Halpern Fiscal. "It is never a bad time to relieve for your futurity, especially in a taxation-advantaged way," he says. "In a 401(1000), yous get a discount on each dollar you lot invest equal to your marginal taxation charge per unit considering yous are contributing pretax dollars."

And ultimately, losing the match is no big bargain, says Deborah Badillo, a certified financial planner with The Lubitz Fiscal Grouping. "Regardless if you take a match or not for one year, you should contribute toward retirement if you lot can," she says. "Ane yr of no lucifer will exist immaterial for retirement projections for a successful retirement. The key is to continue to save in a tax-advantaged method for retirement over your unabridged career."

Retirement Readiness Affected?

If your retirement goal has been affected by the COVID-19 pandemic, at that place are a few things that can exist done to get dorsum on track. "If they observe they were previously too conservatively invested, they can increase the level of gamble exposure until they are closer to their retirement historic period," says Nolan. "The next pick is to adjust the retirement historic period/date. The final step is to increase 1's savings rate; even so, this can be very difficult to do as our financial identity is ofttimes tied to our lifestyle and spending habits."

Read Retirement Advice - It's Actually Ameliorate to Piece of work Longer Than To Relieve More than.

Other Pressing Needs

For his part, Thomas Scanlon, a certified financial planner with Raymond James, always encourages clients to contribute enough to their 401(k) plan to become the employer friction match.

"But if there is no employer lucifer, this deserves a second look," he says.

So, for case, if there are other pressing needs with debts, it may make sense to temporarily turn off the 401(k) contributions and straight these funds elsewhere, says Scanlon. "This could exist to build up a cash reserve or pay down credit cards, etc.," he says.

Review Your Plan

Mullins also says individuals should run their personal finances in much the same mode a business owner runs their business.

"CFOs beyond the business concern world are bracing balance sheets preparing for the repercussions of the Great Shutdown," he says. "Your household balance sheet should be no unlike, you must prepare. If you find yourself needing living expenses during these uncertain times start with a list of your bachelor options. 401(grand) loans, available credit, disinterestedness in your home, etc. Each option has its own benefits and disadvantages. For case, HELOCs may have the best interest rate, but take the longest to get. A credit menu may exist the quickest option, just the double-digit involvement rates on nigh cards volition brand it one of the virtually costly."

Lost Your Job?

To be sure, many workers have lost their jobs, or have been furloughed, or accept been asked to take a pay cut. For that group, Marguerita Cheng, a certified fiscal planner with Blue Ocean Global Wealth, offered this advice: "If y'all've experienced a reduction in income or job loss, information technology's certainly OK to suspend contributions for the time to compensate for the reduction in cash menstruation," she says. "If a person needs revenue enhancement savings and has not experienced a reduction in income, I would propose them to maintain a certain amount so that they don't owe money in taxes."

And during this crisis, she says information technology's prudent to be engaged in all aspects of your personal finances - not just investments. Now, for instance, is a good time to consider refinancing your mortgage, and review your insurance and estate plans.

Trumbower agrees. "If your salary has been cut, and contributing to your 401(grand) would mean that you would struggle to pay essential bills—so, of course, you must prioritize your ability to have housing and nutrient on the table," he says. "Ideally, reduce the contribution rather than eliminate it, with the goal of reinstating it when you are able."

No matter what, Harrison recommends making every effort you lot can to proceed saving for your future, either past fully funding an emergency fund, paying down consumer debt, or putting money towards retirement. "Times of financial crisis can help you lot empathize how planning for your financial future tin can be and so valuable," she says.

Read:

- Plan Enhancements Drive Record Retirement Savings Rates.

- Companies showtime suspending 401(one thousand) contributions due to economic slowdown.

Source: https://www.thestreet.com/retirement-daily/news-commentary/what-to-do-if-your-employer-stops-your-401k-match

0 Response to "What to Do if Your Company Does Not Match 401k"

Post a Comment